22+ utah payroll calculator

To use our Utah Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your.

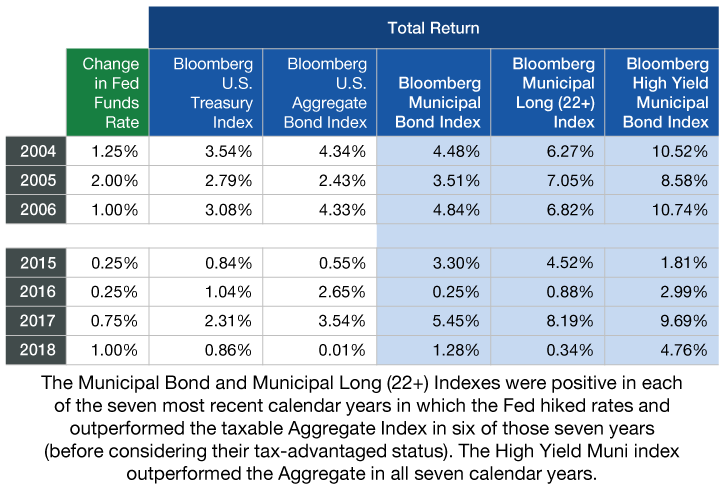

Municipal Bonds And Rising Rates 3 Considerations For Investors

Free Unbiased Reviews Top Picks.

. All Services Backed by Tax Guarantee. Net income Payroll tax rate Payroll tax liability Step 6 Minus everything Once you have worked out your total tax liability you minus the money you put aside for tax. Discover ADP Payroll Benefits Insurance Time Talent HR More.

The state income tax rate in Utah is a flat rate of 495. Well do the math for youall you need to do is enter the. Utah has a very simple income tax system with just a single flat rate.

Calculate your Utah net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Utah paycheck. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Customized Payroll Solutions to Suit Your Needs.

Calculating your Utah state income tax is similar to the steps we listed on our Federal paycheck calculator. Salary Paycheck Calculator Utah Paycheck Calculator Use ADPs Utah Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Get honest pricing with Gusto.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. For inquiries or to schedule. While a state standard deduction does not exist a standard tax credit does exist and.

Get Started With ADP Payroll. This free easy to use payroll calculator will calculate your take home pay. Utah Hourly Paycheck and Payroll Calculator.

For all your hourly employees multiply their hours worked by the pay rate. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

For his on-call period David will be compensated for 525. Utah Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Dont forget to increase the rate for any overtime hours.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Supports hourly salary income and multiple pay frequencies. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. How to calculate annual income. Need help calculating paychecks.

Figure out your filing status work out your adjusted gross income. Ad Compare This Years Top 5 Free Payroll Software. Enter your info to see your take home pay.

Just enter the wages. Ad Process Payroll Faster Easier With ADP Payroll. Overview of Utah Taxes.

Employers can use it to calculate net pay and figure out how. The Best HR Payroll Partner For Medium and Small Businesses. Ad See Why 40000 Organizations Trust Paycor.

Here When it Matters Most. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Utah. Ad No more surprise fees from other payroll providers.

Utah Income Tax Brackets and Other Information. Utah Salary Calculator for 2022 The Utah Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds. For all your salaried.

Ad Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll. After a few seconds you will be provided with a full breakdown of the.

For example if an employee earns 1500. To figure out the amount that David should be paid he would divide the number of actual hours of on-call by 12 18751200 156. Beginning pay period 2 January 18 2014 Pre-2014 sick leave will be locked.

All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. Calculate Gross Wages. Take A Guided Tour Today.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

M3server Review 2022 Is It Worth It

Utah Paycheck Calculator Adp

Liberty Hill Apartments 74 East Birch Hill Ln Draper Ut Rentcafe

Utah Paycheck Calculator Adp

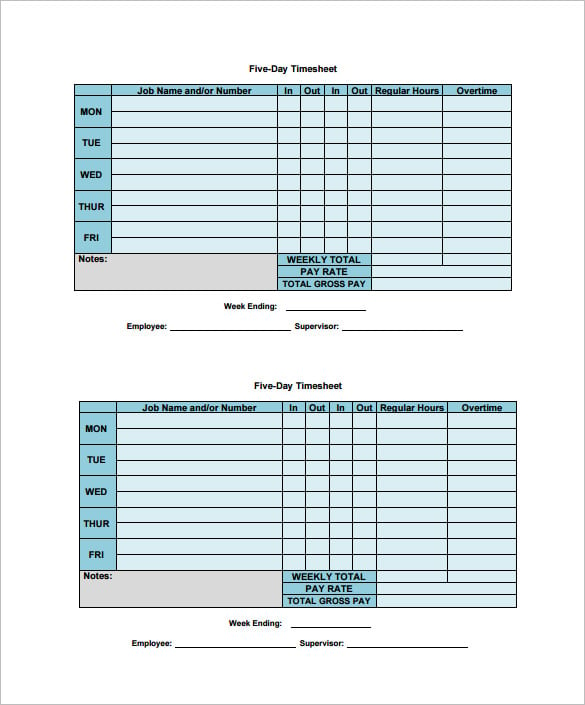

How To Calculate Payroll Hours Minutes

Utah Salary Paycheck Calculator Gusto

Utah Income Tax Calculator Smartasset

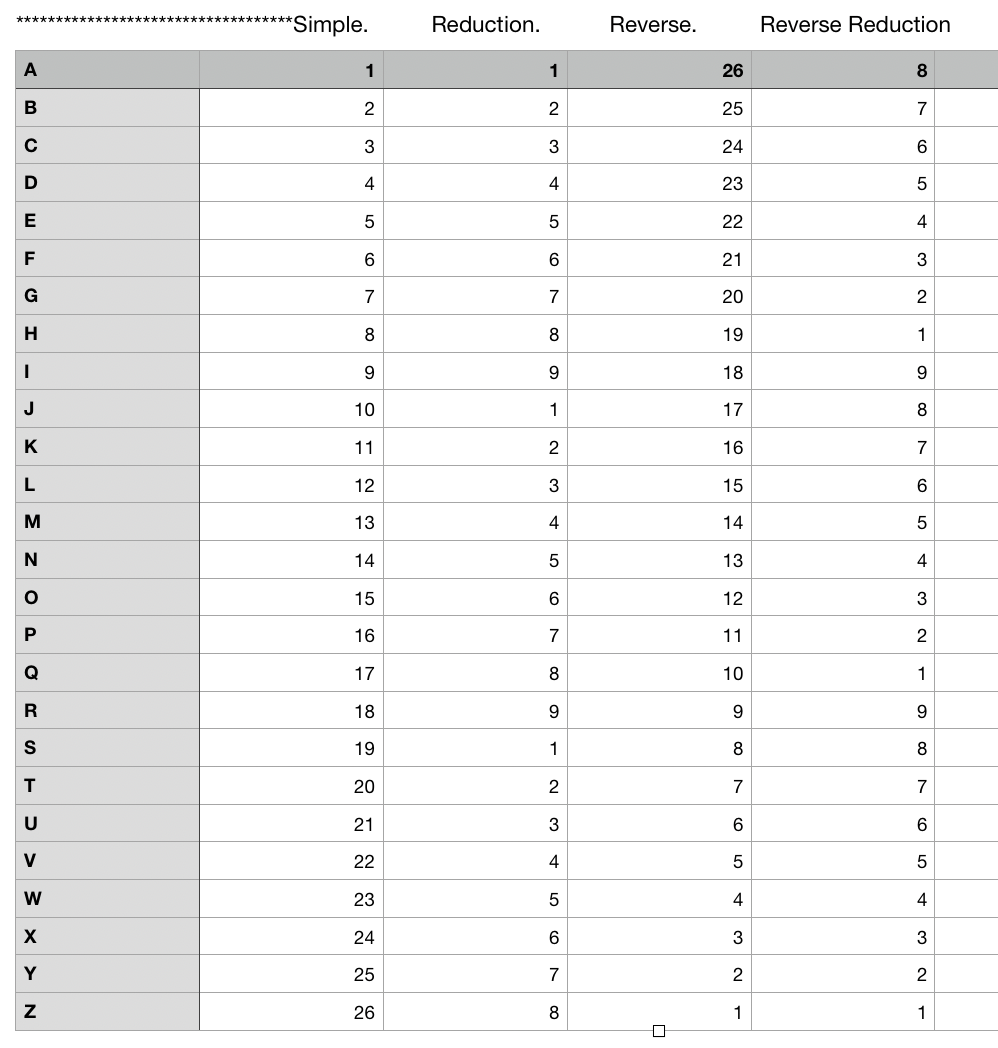

Numbers And The World

Ncac Usaee 2019 Newsletter Archive

Franklin Federal Tax Free Income Fund

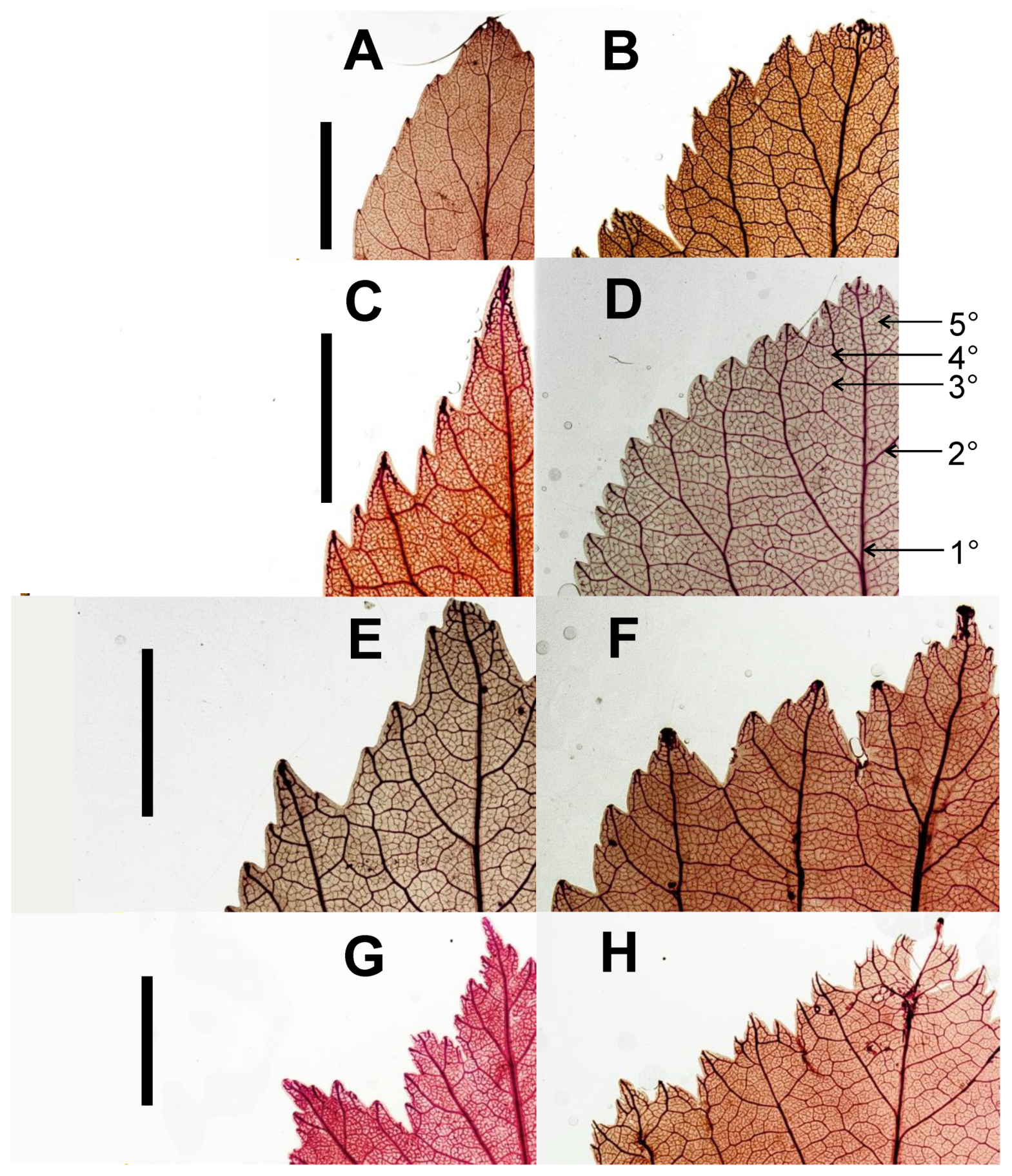

Low Reorganization Energy For Electron Self Exchange By A Formally Copper Iii Ii Redox Couple Inorganic Chemistry

M3server Review 2022 Is It Worth It

Agronomy Free Full Text Niche Shifts Hybridization Polyploidy And Geographic Parthenogenesis In Western North American Hawthorns Crataegus Subg Sanguineae Rosaceae Html

Liberty Hill Apartments 74 East Birch Hill Ln Draper Ut Rentcafe

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Utah Paycheck Calculator Adp

When The Fight Over Ski Pass Prices Began Aspentimes Com